When it comes to developing software solutions at the customer interface, Mimacom has been a partner for years. With its agile project approaches, Mimacom brings real merit.

Background: Digital Services: Focus on user experience for banking customers

The retail banking market is highly competitive and today’s bank customers expect a comprehensive range of online services. Therefore, in 2018, Migros Bank was looking for a digitization partner for the implementation of customer applications and services, who consistently takes the customer’s point of view into account when implementing software projects. The offer of Mimacom covers the requirements of Migros Bank in all aspects.

Solution: Dynamic development capacities thanks to nearshoring model

Since 2018, Mimacom has been supporting Migros Bank as a partner with a highly flexible and transparent nearshoring model. Core and control functions, such as user experience, business analysis and requirements engineering are performed locally in Switzerland and at the customer’s site together with Migros Bank specialists.This results in short communication and decision-making paths, which creates the basis for a trusting and cooperative partnership.

Highly qualified developers from the Spanish near-shoring team, together with the local employees, form high-performance, interdisciplinary teams that can deliver independently. This composition enables services and solutions to be provided at a high and constant quality level. Another advantage of the nearshoring model is that development capacities can quickly and easily adapt to changing circumstances.

A software project grows into a partnership

Mimacom had the opportunity to prove its competencies in the project ″Online Appointment Management″ and convinced with speed, efficiency and quality during the realization of the product. Furthermore, the hybrid implementation model was convincing, bringing onsite and nearshore experts together in a target oriented way and thus maximizing the quality of the output. As a result, Migros Bank chose Mimacom as an important partner for the development of customer applications and services.

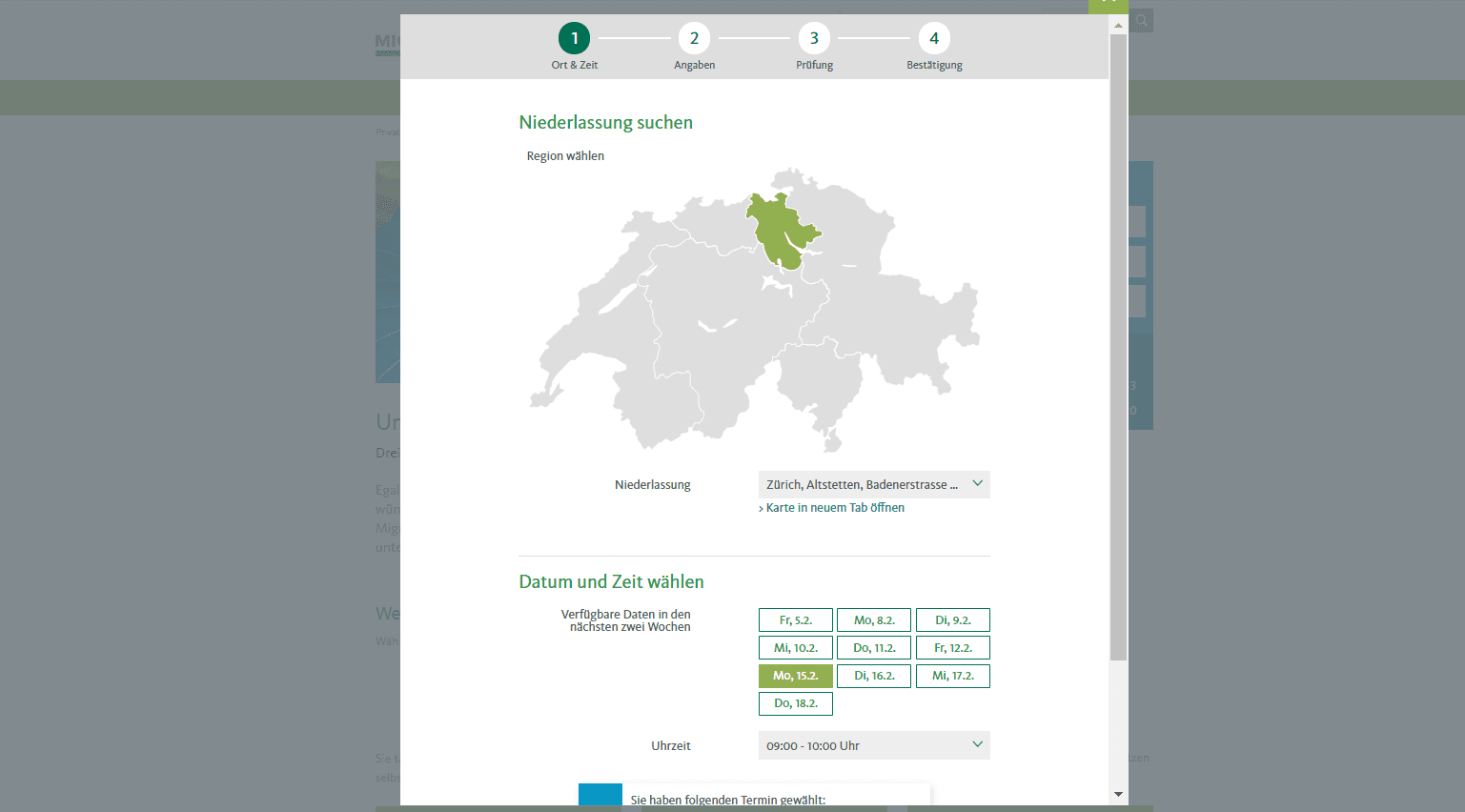

Online appointment setting for new customer acquisition

With the online appointment management, Mimacom realized a digital touchpoint for visitors to the Migros Bank website. Customer appointments are an important basis for new and existing customer business. The online appointment management automates the appointment allocation in the 68 branches of Migros Bank and enables a qualified appointment preparation with the help of automated workflows.

The application automatically provides the customer advisor with all appointment information, enabling optimal preparation for the meeting with a minimum of time. Since the introduction of online appointment management – which now also allows requests for online appointments via video call – Migros Bank has seen an increase in the number and quality of advisory appointments arranged.

The online appointment system is available to all private and corporate customers at www.migrosbank.ch in the sections Investment, Mortgages and Financing.

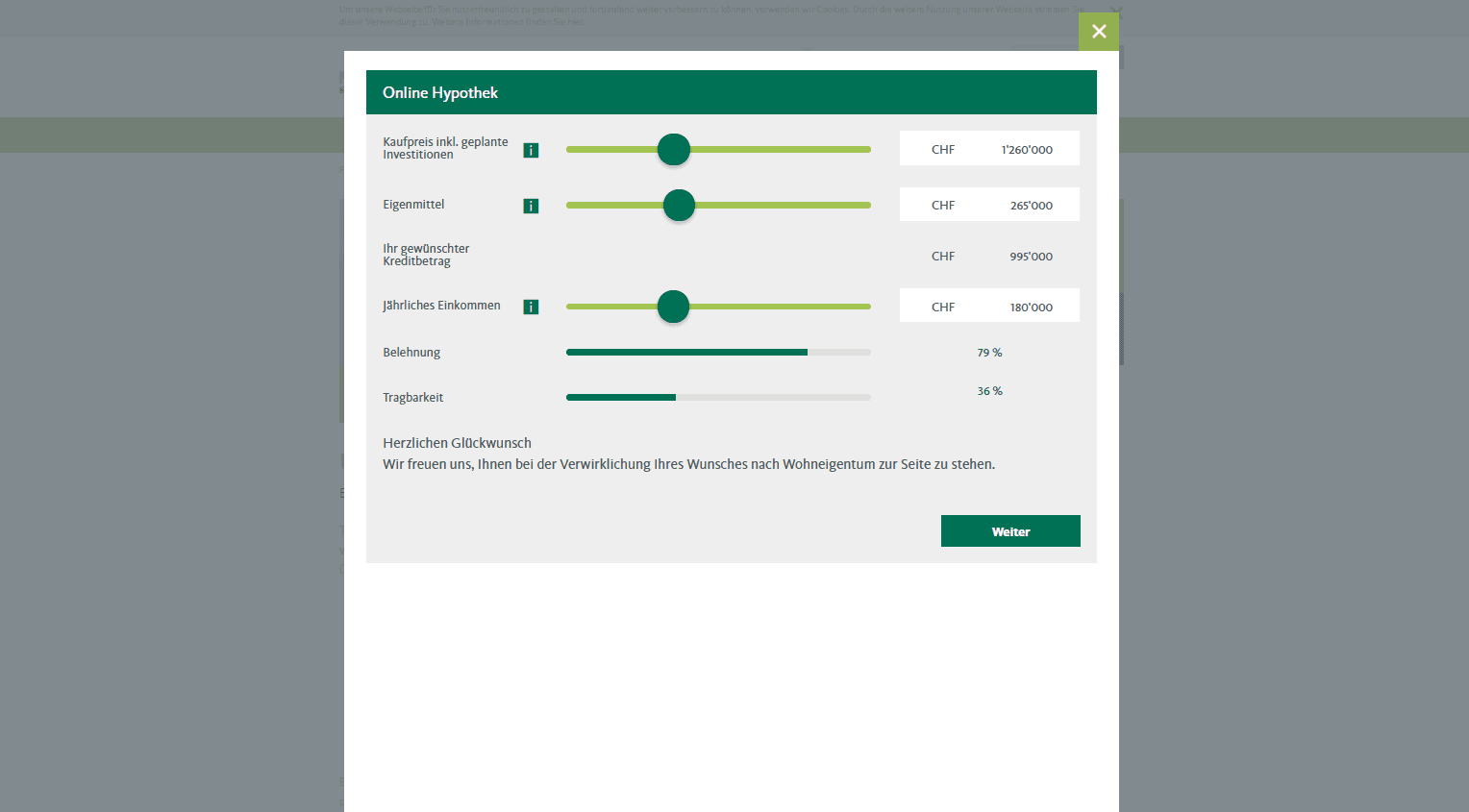

Online mortgage

With the online mortgage, Migros Bank offers the possibility to obtain and apply for mortgage offers directly via the Internet. The online mortgage tool offers an individual mortgage calculator. Based on the purchase price, own funds and income, the customer is presented with three mortgage offers, which differ in their composition, duration and thus in risk profile.

The customer can now personalize his mortgage by adjusting the tranches to his needs and then apply for the online mortgage by specifying the desired property, mortgage composition and exact financing. The application allows the user to upload all relevant documents (such as tax returns, salary statements, floor plans, etc.). The process can be interrupted if necessary and resumed at a later time.

During the processing by Migros Bank, the application informs the customer about every relevant event in connection with his mortgage application via e-mail, e.g. when the mortgage has been approved or further documents are required.

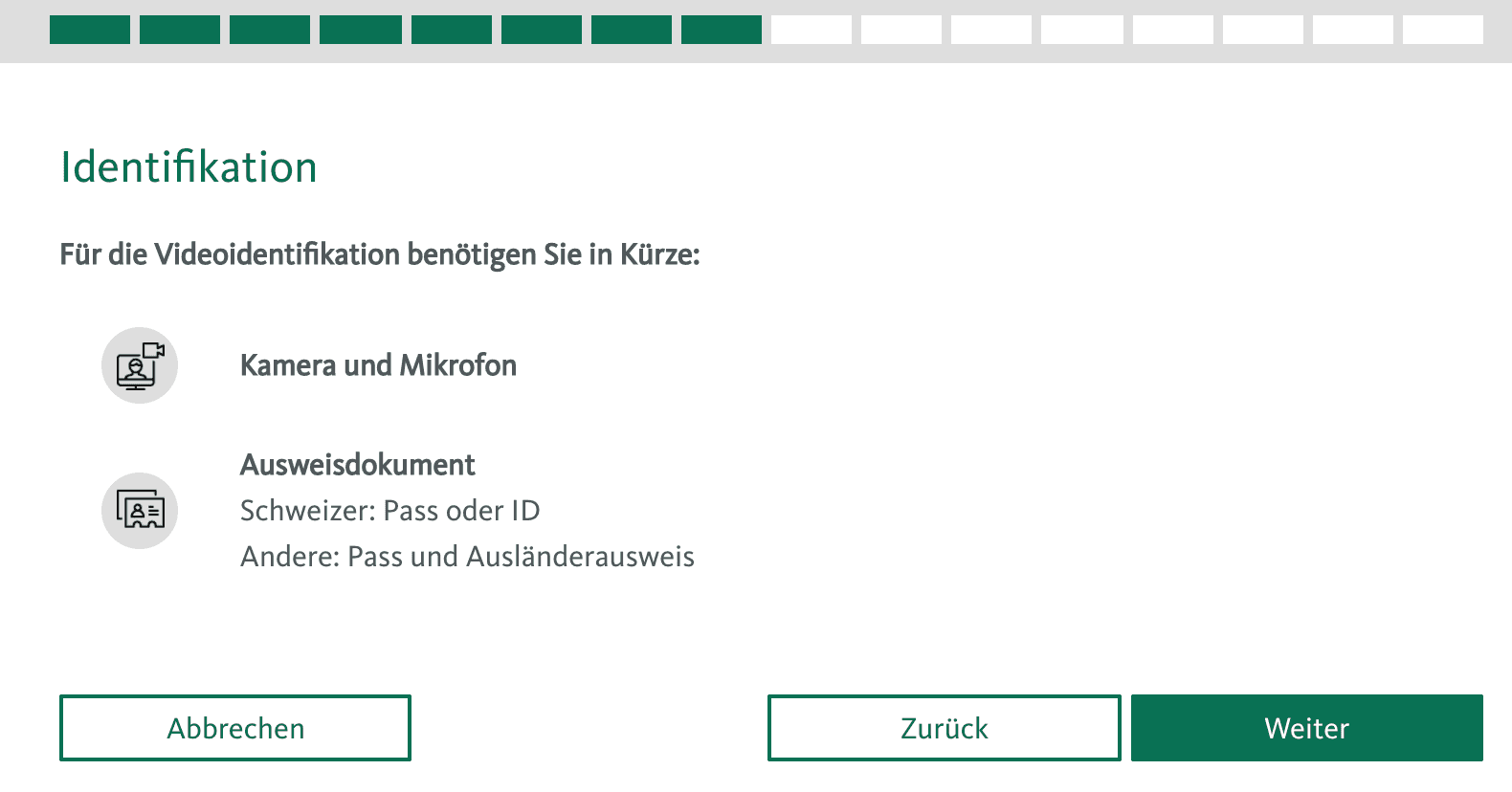

Customer onboarding via video identification: Media continuity-free digital processes for Migros Bank customers

The newly developed customer onboarding application offers Migros Bank customers the possibility to order various financial products easily and conveniently online, and to conclude contracts directly. The customer only has to clearly identify himself via video identification and can then handle the ordering process easily and without media discontinuity. Mimacom realized the front- and backend application as well as the interfaces to the required internal and external peripheral systems.

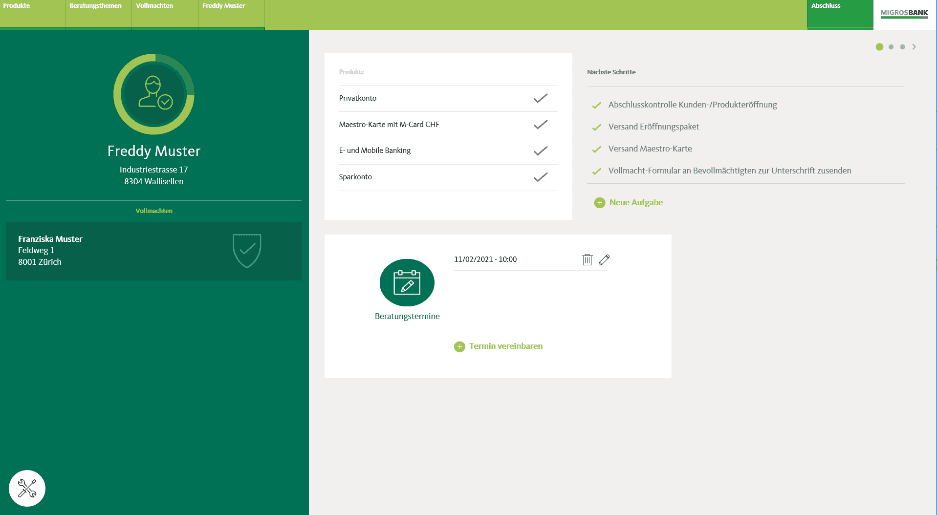

Consultant workstation basic products

The expanded advisor workstation optimally supports the customer advisors in identifying customer needs, creates the basis for all-round advice and thus enables a highly personalized customer experience. With its various modules, the advisor workstation is closely linked to Migros Bank’s core banking system and displays all relevant data to the customer advisor within a few clicks. In addition to maintaining all existing modules, Mimacom is constantly developing new ones (such as the creation of new customers or the opening of basic products) and runs the comprehensive system using DevOps team structures.

Conclusion & Outlook

Today, Migros Bank has numerous online services at its disposal. The initial project-related collaboration has developed into a solid partnership. Migros Bank is continuously expanding its existing online services in cooperation with Mimacom’s nearshoring development team. For new projects and the development of new features, specialists from the areas of user experience, requirements engineering, software architecture, and software development are available to Migros Bank as needed. Migros Bank thus has a flexibly expandable team at its disposal at all times for the implementation of its digital strategy.